Every grower has a budget for fertilizer – but how can you develop a fertilizer plan to maximize returns?

Creating a fertilizer plan to maximize returns is a challenge. There are many factors to consider, some which you don’t have control over. In this blog post, we’ll cover a few of the critical factors affecting your fertilizer plan and how you can maximize returns. We’ve updated this post in 2022 to give you more thorough information to aid your decision-making process.

How to Develop a Fertilizer Plan to Maximize Returns

Are Maximizing Returns, Profits, and Yields The Same?

First of all, what’s the difference between maximizing returns, profits, and yields? Let’s take a look at what each of these things means, and an example.

Maximizing Yield

Maximizing yields simply means getting the very most out of your crop. To develop a fertilizer plan to maximize yields, crops can never be hungry for nutrients. This may mean increasing your fertilizer rates and adding additional secondary or micronutrients into your fertility program. Spoon feeding fertility throughout the season is another great way to ensure your crop has all the nutrients it needs. Foliar applications or adding other nutrients into your in-season nitrogen program have also proven beneficial.

Maximizing Profit

Maximizing profits means, at year-end, you’ve made more money than you ever have. It doesn’t factor in expenses, however. If you are looking for top profit you can be a little risky and spend a few extra dollars if there is high probability to produce a return in future. An economically planned fertilizer program which includes N, P, K and micronutrients is important.

Maximizing Return

Maximizing return means balancing budget and yield. To maximize your returns you’ll need to weigh out every fertilizer input dollar and the potential return before making a buying decision. Often, it’s less about dollars per acre and more focused on total dollars spent.

Yield vs Profits vs Returns

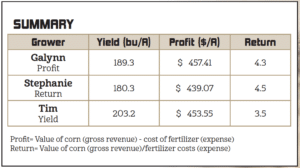

Let’s take a look at a simplified example of yield vs profits vs returns. For this analysis, only fertilizer costs and corn value were used in the final calculations.

Grower Tim achieved a top yield with 203 bu/A, but gave up some profit and had a lower return on investment. In comparison, grower Galynn had a slightly lower yield and improved their return, but won in profit with over $457/A gained. Grower Stephanie had a good yield, with good profits, and maximized their returns. For every dollar spent on fertilizer they received $4.50 in return.

The first, most important tool for developing a plant nutrition program is a good soil test. In today’s economic environment, it is vital to understand what the soil has, and what it doesn’t have, in order to make a well-thought-out fertilizer program. The AgroLiquid agronomy team base all crop nutrition plan recommendations on a soil test, so they can take a targeted approach to best utilize those fertilizer dollars on a grower’s field, in their soils, with their goals in mind.

How to Develop a Fertilizer Plan to Maximize Returns: Testing

The first, most important tool to develop a fertilizer plan to maximize returns is a good soil test. In today’s economic environment, it is vital to understand what the soil has, and what it doesn’t have, in order to make a well-thought-out fertilizer program. The AgroLiquid agronomy team bases all crop nutrition plan recommendations on a soil test, so they can take a targeted approach to best utilize those fertilizer dollars on a grower’s field, in their soils, with their goals in mind.

Collect a Sample

When collecting your soil sample, it’s important to keep best practices in mind. Also, keep in mind any management practice that could affect how, when or the rate of fertilizer that may be applied. This includes past tillage practices, soil amendment placement, cropping patterns and soil type. For instance, if fertilizer is being applied during planting, keep planter placement of crop nutrients in mind, and be sure you are pulling those samples at 6” – 8” in the strip. This is important in getting an informed planter fertilizer recommendation for the area.

Reading the Soil Test

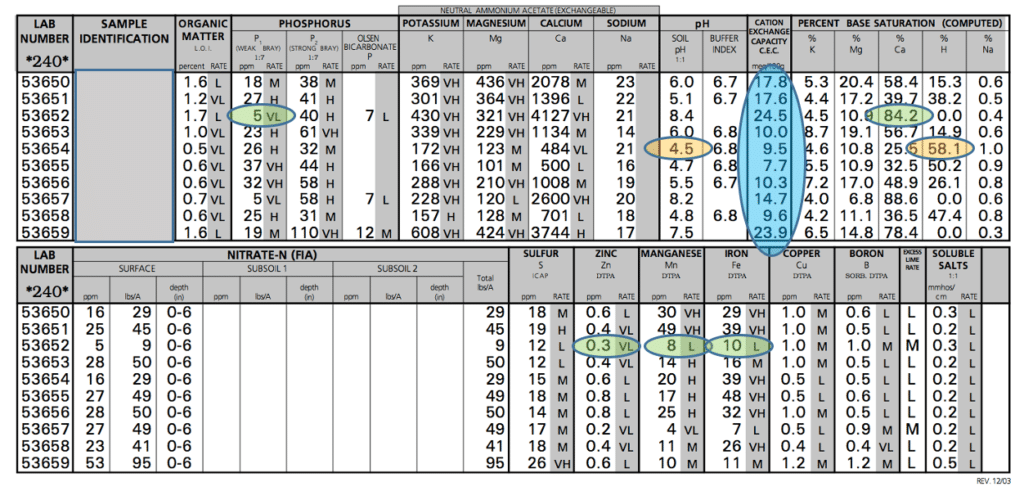

The first section of the soil test to review is the pH, CEC, and percent base saturation section. We get a general indication of the soil texture by the CEC. A soil with a CEC below 8 is considered sandy, whereas a soil with a CEC between 8 and 14 is a medium textured, or loamy soil. When a soil has a CEC higher than 14 there is a fairly high clay content. Those values are not hard-and-fast rules, but generally, the higher the CEC the more clay and organic matter the soil contains.

Soil pH and Nutrient Availability

Soil pH and Nutrient Availability

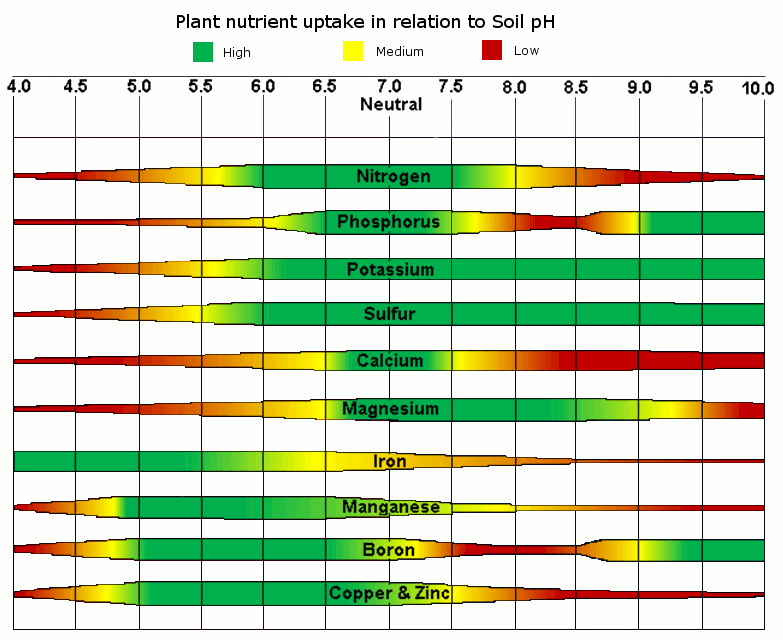

Soil pH has a direct effect on nutrient availability. This chart shows relative nutrient availability at various soil pH levels. Most nutrients are readily available when the soil pH is 6 – 7.5. Notable exceptions are aluminum, where availability drops substantially at pH levels greater than 5, and iron & manganese where availability drops starting at pH 6 and higher. It is also important to note that most bacteria and fungi are most active in soils with pH above 5.5.

Cation Exchange Capacity (CEC)

The nutrient holding capacity of the soil is indicated on a soil test as Cation Exchange Capacity (CEC, highlighted in blue on the sample test below). Also, there are some key cations that comprise most of the holding capacity of the soil.

The main cations are listed as percentages of base saturation. Calcium (Ca) should be around 70%. If that number gets to be higher than 75%, then it can have some negative impact on other nutrients (reference the green ovals below to see the impact of high Ca). Magnesium (Mg) should be around 15%. Potassium (K) is optimum at about 5%, sodium (Na) should be less than 2% and hydrogen (H) about 10-15%. They should total 100%.

Hydrogen is the ion that causes acidity, so the more of it you have, the more acidic your soil (the orange ovals show the relationship between hydrogen and acidic pH, which is a pH<7). You correct this by adding desirable cations to replace the hydrogen. In high pH soils, you may need to add elemental sulfur to remove some of the cations. Good crop production can be obtained on less than an optimum balance of these cations, but numbers in the ranges given help crops endure stresses of the growing season.

Developing a Fertilizer Plan with a Soil Test

With this overview, you can see that when looking at a soil test, there are many relationships that exist among nutrients and you shouldn’t just evaluate each nutrient on its own, or address it according to the number listed.

In the example shown, you’d be tempted to look at the weak bray phosphorus (P1) test and apply a very high amount of phosphorus. But if that phosphorus is broadcast, the excess Ca represented by the 84.2% is just going to tie it up, rendering it unusable by the crop you are intending to feed. So, when you are thinking about fertilizing your crop, you need to stay focused on what the crop will be able to use and not what you are applying to the soil. Much of the phosphorus that is in the soil on the test with the high Ca will never be used by the crop. The calcium-phosphorus bond is too strong for the plant to be able to extract the phosphorus from the calcium.

This just illustrates one of many possible reactions that can limit the ability of a crop to utilize nutrients in the soil. Over time, some of the phosphorus will separate when Mother Nature provides rain and a fractional amount will be released.

Making Decisions

Decisions regarding crop nutrition can be complex as yield expectations rise and economics remain challenging. AgroLiquid takes measures to mitigate the impact of imbalances that exist by protecting our nutrients from many of the reactions that can occur. The purpose for using fertilizer is to feed the crop. Thinking about fertilizer in terms of how much is used by the plant rather than how much is applied to the soil is a critical step. A complete soil test is a good indicator of how much efficiency can be expected with applied crop nutrition. AgroLiquid’s unique protection improves efficiency dramatically. Couple that with a staff that has a thorough understanding of the nutrient relationships in the soil and you will receive a value that goes beyond the return on your investment.

Soil pH and Nutrient Availability

Soil pH and Nutrient Availability